No Data

HYG250425P73000

- 0.03

- 0.000.00%

- 5D

- Daily

News

The USA debt crisis is approaching, and BTC will reach a new high again.

An imbalanced world of policies, a world where trust is scarce, a world where debt is monetized - these are the main sources of Bitcoin's greatest bull market.

The long-term bear market for the US dollar has arrived! Deutsche Bank: This will have a profound impact on the Global economy and capital flows.

Deutsche Bank believes that the dollar bull market has ended and a bear market has begun. The core reasons include a decrease in the global willingness to finance the U.S. twin deficits, a peak in the holdings of U.S. Assets, and a tendency among many countries to promote growth through domestic fiscal measures. The EUR/USD Exchange Rates are expected to reach 1.15 by the end of 2025, gradually approaching 1.30 thereafter.

Is Recession 'Inevitable'? Markets Say Don't Be so Sure.

Keep Your Portfolio Flexible While Trump and Powell Do Their 'Fed Independence' Dance.

U.S. Treasuries Rally as Worries Over Trump Tariffs and U.S. Fed Ease

Daily Roundup of Key US Economic Data for April 23

Comments

By Robert Musella – Founder of The Roman Sun Tzu Method™

⸻

“The battlefield is shifting—and only the prepared will survive.”

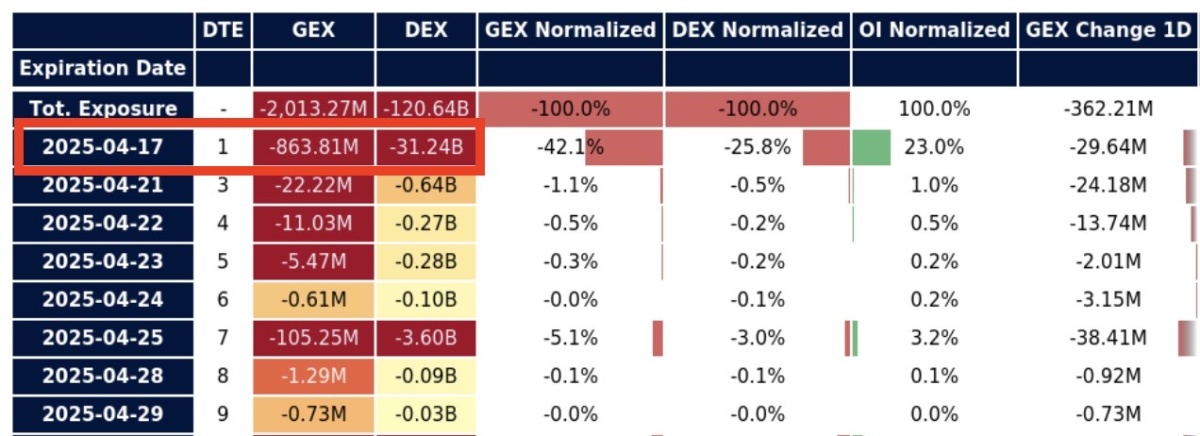

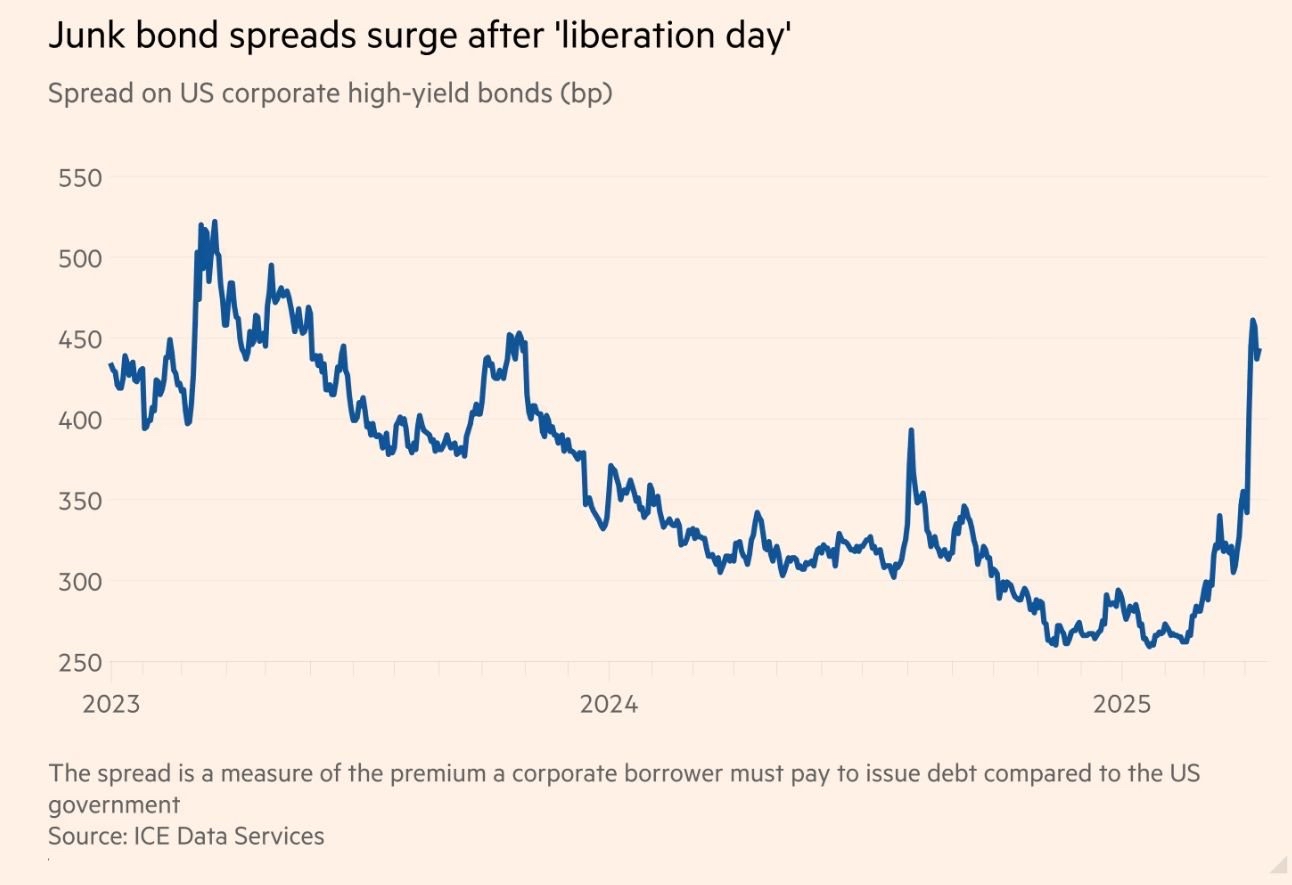

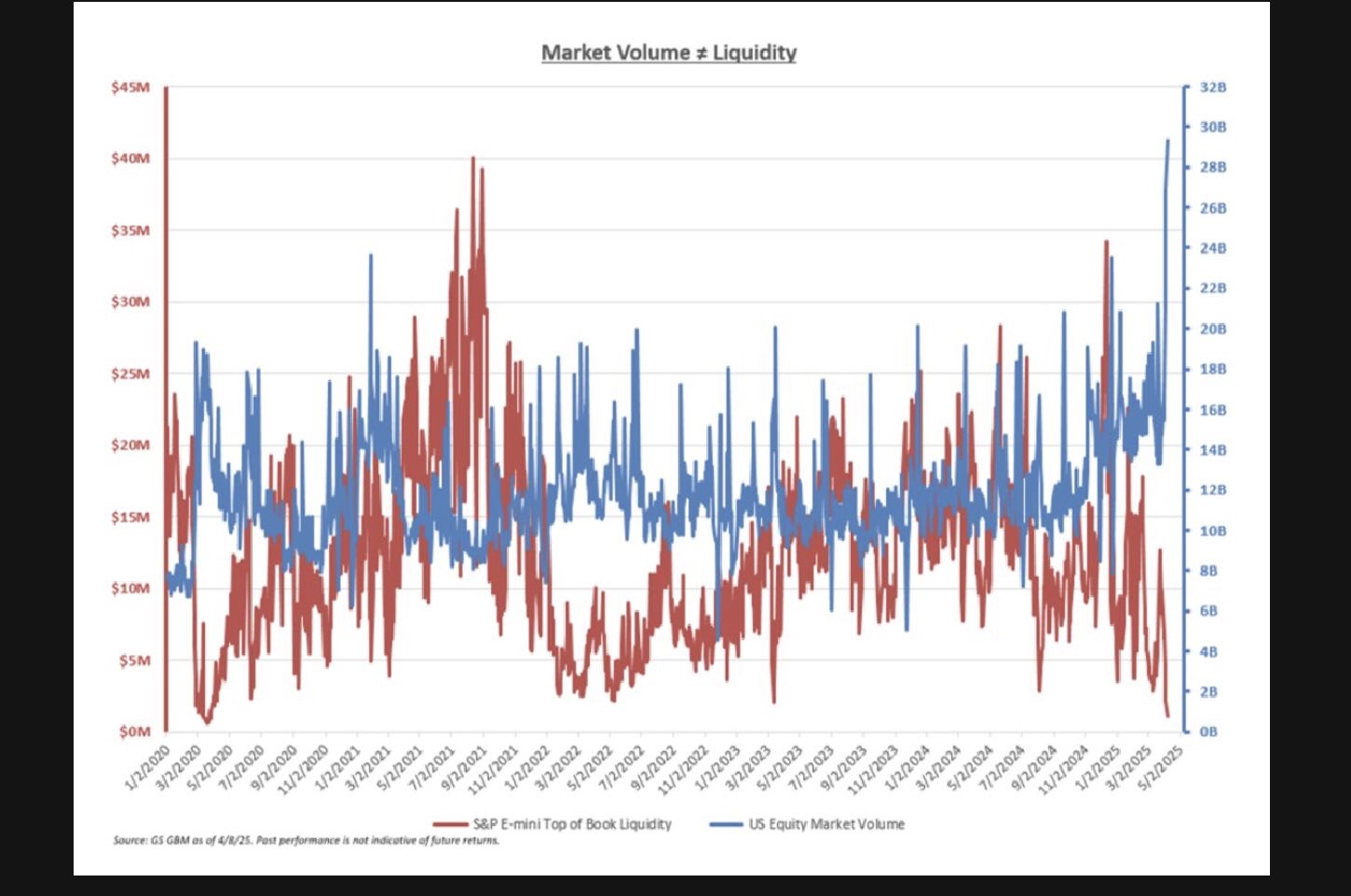

On April 17, we’re not just witnessing expiration-driven chop. We’re watching a multi-front war unfold across equities, credit, options, and global macro flows.

Let’s break down the signals that matter—and what they mean for your next move...