US OptionsDetailed Quotes

FBL250516P48000

- 0.00

- 0.000.00%

15min DelayClose Apr 24 09:30 ET

0.00High0.00Low

0.00Open0.00Pre Close0 Volume0 Open Interest48.00Strike Price0.00Turnover186.20%IV-93.55%PremiumMay 16, 2025Expiry Date23.20Intrinsic Value100Multiplier21DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type-0.8944Delta0.0171Gamma1.05Leverage Ratio-0.0434Theta-0.0181Rho-0.94Eff Leverage0.0109Vega

GraniteShares 2x Long META Daily ETF Stock Discussion

$GraniteShares 2x Long META Daily ETF (FBL.US)$ $Meta Platforms (META.US)$ the morning note that I'd like to say about Meta/ Facebook. if they were to be broken up... the sum of the parts are worth a hell of a lot more than the whole.. you should not be afraid at all if the courts decide that Facebook would be split up. you'll make more money. it's not going to come to this I think because that slimeball Zuckerberg has buddy buddied up with President Trump, I think they might work out some settleme...

2

1

$GraniteShares 2x Long META Daily ETF (FBL.US)$ if tomorrow is not a total bloodbath we have the ability to rally to about 34 1/8 on this ETF which is just slightly above the 20 day.

so if president Trump comes out and right now the story circulating 20% across the board tariffs on virtually every product. if it's 15% if he does what I propose one of the things is you give these nations an alternative you give them the ability to buy US debt long term 30-year debt at auctions every month to redu...

so if president Trump comes out and right now the story circulating 20% across the board tariffs on virtually every product. if it's 15% if he does what I propose one of the things is you give these nations an alternative you give them the ability to buy US debt long term 30-year debt at auctions every month to redu...

4

3

$GraniteShares 2x Long META Daily ETF (FBL.US)$ this is kinda sad

16

$GraniteShares 2x Long META Daily ETF (FBL.US)$ there's big institutional money buying meta

there's more institutional money going into meta then there is any of the other mag sevens

there's more institutional money going into meta then there is any of the other mag sevens

2

1

$GraniteShares 2x Long META Daily ETF (FBL.US)$ $Meta Platforms (META.US)$

we're almost an hour into the morning the first few minutes are the markets all over the place everything gets discounted you get retail that panics retail is selling out the market makers are sucking up cheap stock they flip it the minute that there's an uptick they make millions and millions of dollars and are basically a riskless transaction happens every day.

the point is we're almost an hour into the market you need to...

we're almost an hour into the morning the first few minutes are the markets all over the place everything gets discounted you get retail that panics retail is selling out the market makers are sucking up cheap stock they flip it the minute that there's an uptick they make millions and millions of dollars and are basically a riskless transaction happens every day.

the point is we're almost an hour into the market you need to...

5

Who likes the market tonight?

So far so good to me. Big movers $Meta Platforms (META.US)$ $Apple (AAPL.US)$ $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ $GraniteShares 2x Long META Daily ETF (FBL.US)$

Others to hurry up $Amazon (AMZN.US)$ $NVIDIA (NVDA.US)$ $Microsoft (MSFT.US)$ $Taiwan Semiconductor (TSM.US)$ $Palantir (PLTR.US)$ $Booking Holdings (BKNG.US)$ $Advanced Micro Devices (AMD.US)$

So far so good to me. Big movers $Meta Platforms (META.US)$ $Apple (AAPL.US)$ $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ $GraniteShares 2x Long META Daily ETF (FBL.US)$

Others to hurry up $Amazon (AMZN.US)$ $NVIDIA (NVDA.US)$ $Microsoft (MSFT.US)$ $Taiwan Semiconductor (TSM.US)$ $Palantir (PLTR.US)$ $Booking Holdings (BKNG.US)$ $Advanced Micro Devices (AMD.US)$

22

20

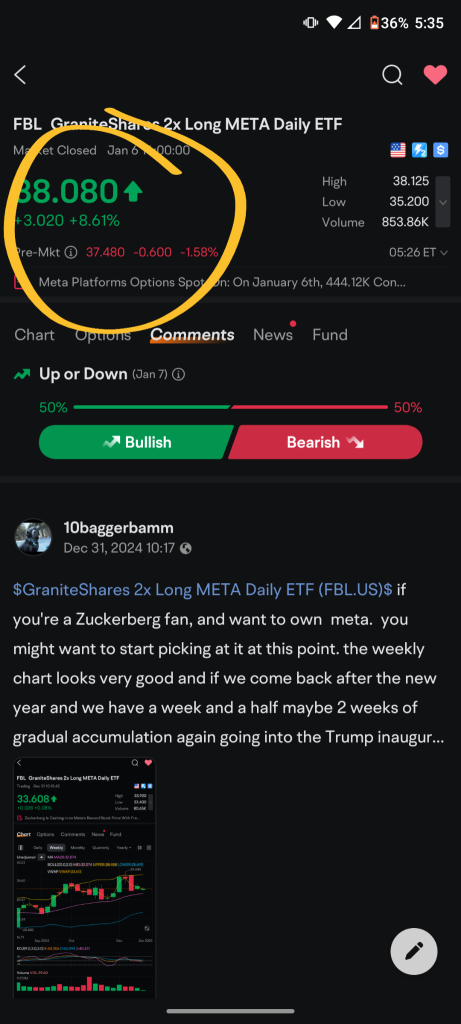

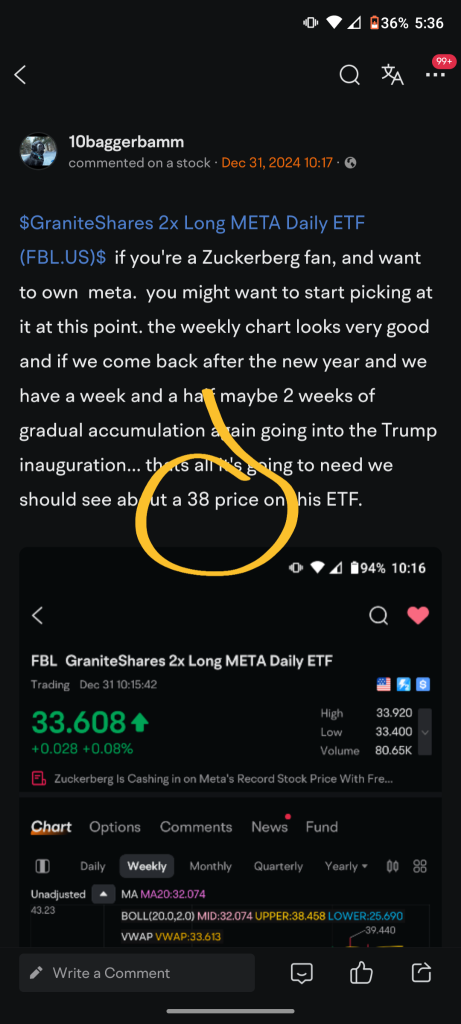

$GraniteShares 2x Long META Daily ETF (FBL.US)$ if you're a Zuckerberg fan, and want to own meta. you might want to start picking at it at this point. the weekly chart looks very good and if we come back after the new year and we have a week and a half maybe 2 weeks of gradual accumulation again going into the Trump inauguration... thats all it's going to need we should see about a 38 price on this ETF.

$GraniteShares 2x Long META Daily ETF (FBL.US)$ look at Facebook down I wonder what Mark Zuckerberg is thinking today.. 🤣

maybe it has something to do where Trump said he's going to hold all of those people accountable

maybe it has something to do where Trump said he's going to hold all of those people accountable

1

1

No comment yet

Qapy : if they get broken up, means holders will have split and have 3 stocks? wut?