No Data

BIL SPDR Bloomberg Barclays 1-3 Month T-Bill ETF

- 91.665

- +0.005+0.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Is Recession 'Inevitable'? Markets Say Don't Be so Sure.

Flipping out faster than flipping a book? Trump once again blasts Powell: Not lowering interest rates is a mistake!

① The President of the USA, Trump, criticized Federal Reserve Chairman Powell again on Wednesday, accusing him of keeping interest rates too high and expressing that he might give him a call. ② Trump has recently criticized Powell multiple times and has not ruled out the possibility of firing Powell, but reportedly the Secretary of the Treasury and the Secretary of Commerce advised him against it.

Goldman Sachs: The risk of a recession in the U.S. is underestimated, focusing on China's Internet, Brokerage, and others.

Goldman Sachs predicts that the Global shipments of Smart Phones will remain flat in 2025 (1.24 billion units).

Harmack stated: The Federal Reserve should continue to reduce its balance sheet, and the MMF policy needs to remain stable.

Harmack stated on Wednesday that the current situation still supports the Federal Reserve's continued reduction of its balance sheet. In the face of significant uncertainty, now is not the time to change MMF policy.

Citadel CEO Griffin: Trump's trade war has become "meaningless", damaging the USA's Assets brand and making Americans poorer.

Griffin believes that Trump's actions have tarnished the once "unparalleled" excellent reputation of USA Assets, including US Treasury bonds, the strength of the US dollar, and national creditworthiness. His tariff policies have failed to bring manufacturing back to the USA and have instead made the USA "20% poorer all around," making the trade war "meaningless" and producing no winners.

Bond giant PIMCO is "shorting": underweighting the dollar!

Investors are increasingly turning to "home country Assets."

Comments

The release of the U.S. Consumer Price Index (CPI) data for August has once again confirmed market expectations regarding inflation trends.The year-over-year growth rate of the overall CPI has fallen to 2.5%, while core CPI remains stable. This not only indicates that market supply and demand are gradually balancing, but also provides investors with a good opportunity to rea...

In a text book manner, it was options expiry day April 19 so the market' pull back from its record all time highs was naturally going to be exacerbated. Shorts were exercised, the ASX200 $S&P/ASX 200 (.XJO.AU)$ dropped 0.98% on Friday, and then rose up 1.1% on Monday April 22, with market participants e...

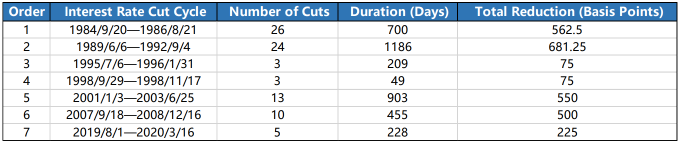

When central banks embark on an easing cyc...

最帅韭菜 : 2026 hit 1200 I think

Dontchaknowme 最帅韭菜 :