No Data

4063 Shin-Etsu Chemical

- 3923.0

- +137.0+3.62%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

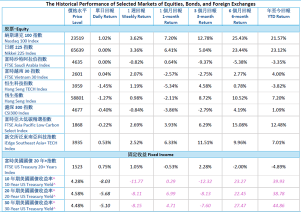

Recovery to 35,000 yen due to easing of US-China trade tensions and expectations from the Japan-US finance ministers' meeting.

The Nikkei average continued to rise, finishing the day at 35,039.15 yen, up 170.52 yen, recovering the 35,000 yen mark for the first time in three weeks with an estimated Volume of 1.8 billion 80 million shares. The U.S. market on the 23rd rose on expectations of easing U.S.-China trade tensions following reports from U.S. Broadcasting that the Trump administration is considering lowering tariffs on China. Following this trend, the Tokyo market began with Buy activity focused on high-tech stocks, and the Nikkei average reached 35,287 shortly after the opening.

The Nikkei average is up about 645 yen, boosted by a weaker yen and a stronger dollar, recovering to the 35,000 yen level for the first time in about three weeks as of the morning session on the 23rd.

On the 23rd, around 10 AM, the Nikkei average stock price fluctuated at around 34,865 yen, up about 645 yen from the previous day. At 9:07 AM, it reached a high of 35,142.12 yen, up 432.52 yen, recovering to the 35,000 yen range for the first time in about three weeks during trading hours since the 9th. In the USA market on the 22nd, it was reported that U.S. Treasury Secretary Yellen indicated that trade friction with China is moving towards easing in a closed-door meeting, with the NY Dow and Nasdaq Composite Index both rising for the first time in five days.

The sentiment of individual investors is showing an improving trend.

[Stocks Opening Comment] On the 21st, the Japanese stock market is likely to see movements for profit-taking on last week's gains, although there is an awareness of resilience aimed at a rebound amid limited market participants. The American and European markets were closed on the 18th due to the Good Friday holiday. Europe will also be closed on the 21st for the Easter Monday holiday, making trading less active. The Nikkei 225 Futures night session closed at 34,650 yen, down 180 yen compared to the daytime.

No plans (21st) [Financial results schedule]

※ The above Calendar is just a schedule and may be subject to change due to company circumstances. --------------------------------------- April 21 (Monday) --------------------------------------- April 22 (Tuesday) <2268> Thirty-One <3091> Bronco B <4479> Makua-ke <4684> Obic <4733> OBC

Shin-Etsu Chemical Industries (ADR) (SHECY.US) will release its Earnings Reports after the market closes on April 24.

$Shin-Etsu Chemical Industry (ADR) (SHECY.US)$ will release its Earnings Reports after the market closes on April 24, and investors are advised to pay attention. How has its performance been previously? $Shin-Etsu Chemical Industry (ADR) (SHECY.US)$ had revenue of 663.238 billion yen, Net income of 150.398 billion yen, and EPS of 34.93 yen for Q3 2025. For Q4 2024, the revenue was 591.534 billion yen, Net income was 124.166 billion yen, and EPS was 28.45 yen. The accounting standards used for the above data are NonUS_GAAP. Futubull reminder: 1

JINSHD, Morinaga Milk, etc. (additional) Rating

Downgrade - Bearish Code Stock Name Brokerage Firm Previous Change After --------------------------------------------------------- <3479> TKP SMBC Nikko "1" "2" <4151> Kowa Kirin Daiwa "3" "4" <7272> Yamaha Motor Morgan Stanley "Overweight" "Equal Weight" Target Price Change Code Stock Name Brokerage Firm Previous Change After--------------------------------

Comments

United States

Goldman Sachs expects US companies to achieve their highest quarterly profits in 3 years, which will ultimately lead to an increase in the performance of US stock market indices.

US Labor Market Losing Steam As Unemployment Rate Climbs To 4.1%

The U.S. Department of Labor reported robust job growth in June, with non-farm payrolls increasing by 206,000, compared to an estimated 190,000. Average hourly earnings rose by 0.3% month-ove...

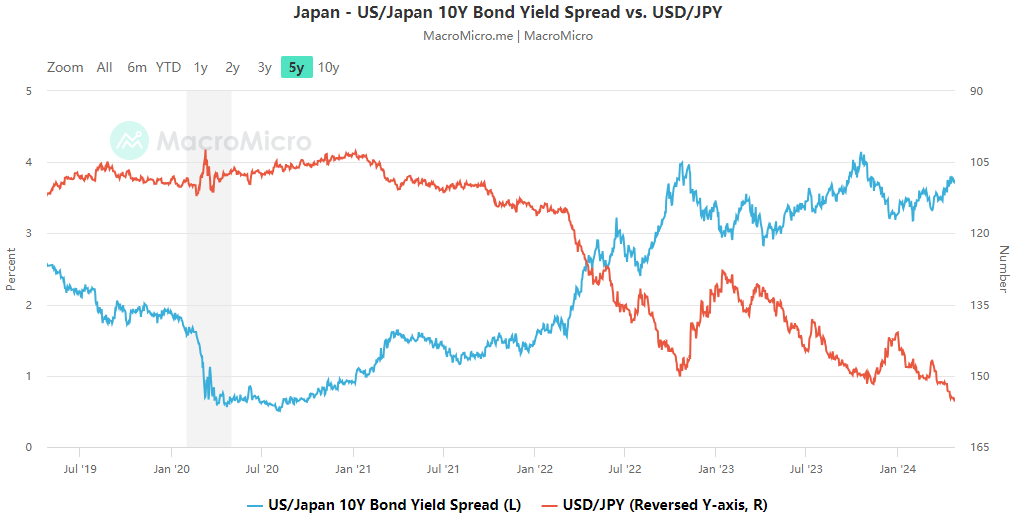

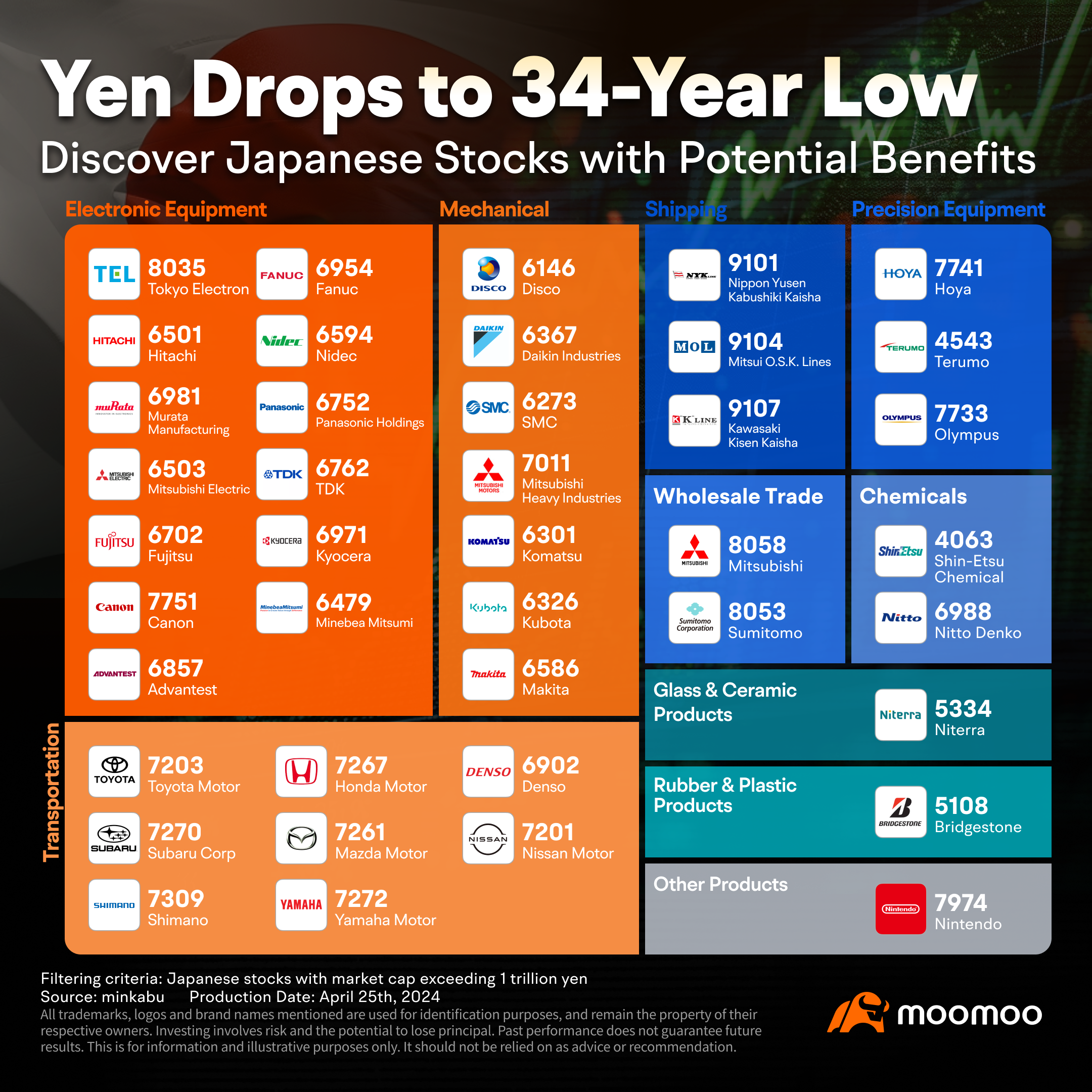

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

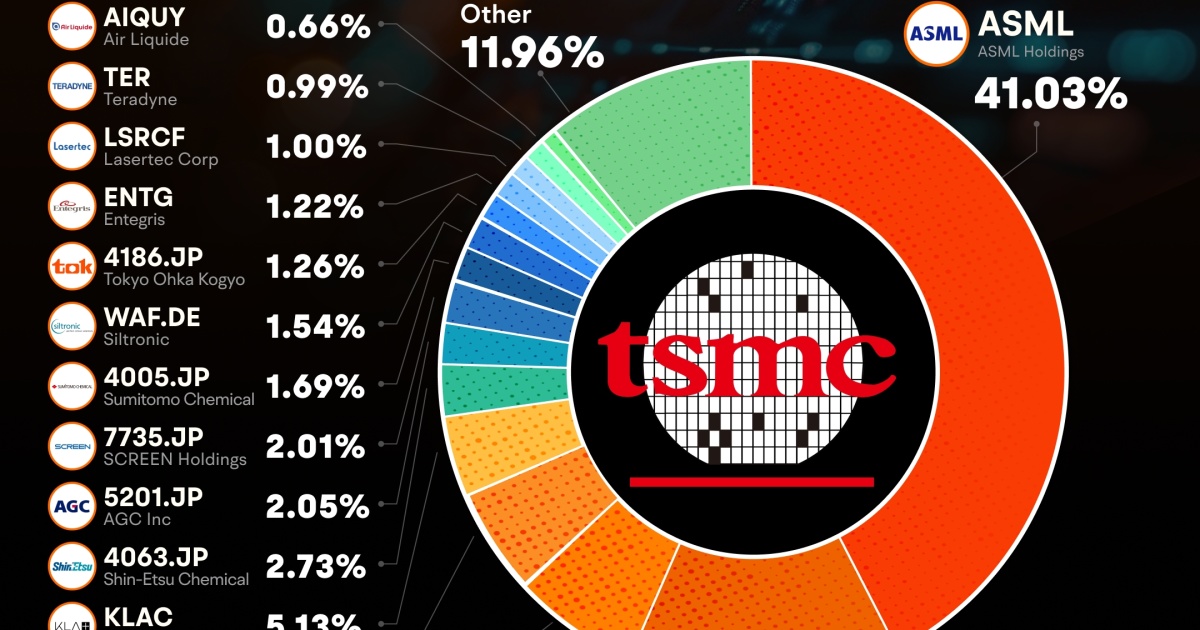

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...